Top 5 Best Bitcoin Mining Pool in 2025

In this article, we will take a closer look at the best mining pools that those who want to start Bitcoin mining should check out.

Bitcoin mining pools are groups of miners who combine their hashing power to increase their chances of winning a block reward. In simpler terms, miners connect their hardware to the pool’s server instead of building their own mining infrastructure. Block rewards earned in mining pools are divided according to the hashing power provided by each participant.

Mining pools have emerged as Bitcoin mining has become increasingly competitive and costs have increased, making it difficult for small-scale or individual miners to earn regular income. Even without considering energy and power costs, a significant amount of resources and capital are required to generate regular and profitable income.

Advantages of Joining a Mining Pool

- Consistency: Ability to earn rewards more frequently compared to solo mining.

- Accessibility: You can participate without investing in large-scale hardware or high electricity.

- Support: Many pools offer guidance, tools, and support to inexperienced miners.

Mining pools increase security by allowing more miners to join the network, maintaining decentralization and preventing a single entity from dominating the blockchain.

Competition for miners is fierce, so many people choose pool mining to ensure stable earnings and contribute to the security of the network. But as with everything, there are advantages and disadvantages:

Advantages and Disadvantages of Solo Mining

Advantages:

- Full control over all rewards from mining.

- There is no obligation to pay commission fees to the pool operator.

Disadvantages:

- Irregular rewards; there may be long periods between successful block mining.

- High hardware and electricity costs.

Advantages and Disadvantages of Pool Mining

Advantages:

- Generate more regular income through collaboration.

- Lower initial investment compared to solo mining.

Disadvantages:

- Pool fees can reduce overall profits.

- The miner has less independence as the pool operator usually makes the decisions.

How Does Bitcoin Mining Work?

Now that we’ve covered the basics, let’s dive into the details. To explain how Bitcoin mining works, let’s take joining a BTC mining pool as an example.

Bitcoin Miner Selection

Most Bitcoin miners use ASIC devices like the Antminer S19 or S9. Because traditional GPUs and CPUs are no longer profitable for mining Bitcoin, the mining device you use must meet current efficiency standards to remain competitive.

Additionally, you need to set your power supply unit (PSU) to match the power consumption of the miner. For example, an Antminer S9 consumes around 1,375 watts. So it’s important to use a powerful and reliable PSU.

You should also establish a stable wired Ethernet connection (recommended), as wireless connections can be prone to interruptions due to factors such as physical obstructions, high latency, and network congestion. These interruptions can prevent your miner from transferring processing power to the pool in a timely manner.

Miner Settings and Pool Selection

After connecting the miner and the PSU, use a network scanner (for example, Angry IP Scanner) to find the miner on your local network. The scanner will show the IP addresses of all connected devices on your network. After you have detected the IP address of your miner, you can access the control panel of the device by entering it in a browser.

Miners usually have default login credentials (for example username/password: root/root), but for security reasons it is recommended that you change this information immediately.

Choosing a Bitcoin Mining Pool

Beginner miners should consider the following criteria when choosing pools:

- Commission rates

- Payment structure

- Security measures

- Server location

Some of the best Bitcoin mining pools are:

- F2Pool

- Foundry USA Pool

- Slush Pool

After selecting a pool, you must create an account with a username and password. Your username will usually be your pool account name + worker name (for example: “account_name.miner_name”). The password can be any value determined by the pool.

Configuring the Miner

Find a list of Stratum addresses by going to the mining pool’s website. Stratum is a URL protocol that allows your miner to send and receive transactions. While pools usually have a public Stratum address, choosing the closest server will result in lower latency and higher efficiency.

Go to the settings section of your miner and enter the Stratum address of your chosen pool, your username and password. After saving the settings, your miner will start directing hash power to the pool.

Bitcoin Wallet Link

To receive your earnings, you need to connect your Bitcoin wallet to your pool account. Most pools allow users to set a minimum payout threshold, so your earnings will be transferred to your wallet once they reach a certain amount.

Start Mining

Once the configuration is complete, your miner sends shares to the pool, proving that they have contributed to the solved cryptographic puzzles. The processing power of all the miners participating in the pool is combined to try to find a block. When a new block is successfully mined, you earn a reward proportional to your contribution.

You can monitor your miner's performance via its control panel or the pool's website.

How Are Rewards Distributed in Bitcoin Mining Pools?

There are three types of compensation models for rewards. Each approach offers specific advantages and disadvantages regarding fees, rewards, and risks:

Pay-Per-Share (PPS) : In the PPS model, you receive a fixed, predetermined payment for each share your mining rig sends to the pool. The pool operator assumes the risk of a block not being found, providing you with a predictable and regular income.

Full Pay-Per-Share (FPPS) : FPPS improves on the PPS model and includes a fixed payout for each share, in addition to the block reward, a share of estimated transaction fees. This method smooths out the volatility of transaction fee revenues, resulting in more predictable returns, but may come with slightly higher fees as the pool operator takes on more risk.

Pay-Per-Last-N-Shares (PPLNS) : This method only pays when the pool finds a block, and rewards are distributed proportionally based on the last N shares of all miners. Your reward may fluctuate. If the pool is unlucky or you get disconnected before a block is found, your earnings for that period may be low or zero. However, over time, this method can give higher rewards during lucky periods.

Choosing the Appropriate Payment Model

Choosing the reward distribution model is as important as choosing the right pool. There are four main factors to consider: risk tolerance, fees, mining goals, and operator loyalty. These can be summarized as follows:

PPS and FPPS are suitable for those who want a fixed income and want to avoid the volatility associated with block discovery. However, PPS and FPPS pools generally charge higher fees because they take on more risk, but they pay participants regardless of block discovery.

PPLNS pools offer lower fees, but can be much more volatile. The payout amount can be irregular depending on how often the pool finds blocks. That is, the more blocks are found, the higher the earnings.

In general, there are two reasons why a miner might choose PPS or FPPS : either they have limited resources or they want predictable, regular income. However, those with significant hashing power and resources often prefer PPLNS to generate larger returns . This means accepting short-term uncertainty while maximizing total returns in a bull market, in exchange for the largest rewards.

Risks of Using Bitcoin Mining Pools

When using a BTC mining pool, there are three main risks that miners should be aware of:

Concentration of power: It’s no secret that large pools can have a large share of the Bitcoin network’s total hash power. Such concentration of power defeats the purpose of decentralization, as a few entities have increasing influence over transaction validation and block production.

Another risk is chain and pool manipulation. Pools may resort to unethical practices such as hiding valid blocks or censoring certain transactions, which can compromise the security and reliability of the network. Furthermore, since operators have significant control over reward distribution, dishonest parties may manipulate payouts, delay rewards, or simply disappear with participants’ funds (this is called an “exit scam”).

Security concerns: When evaluating any mining pool, it is wise to verify its track record, security measures (e.g. advanced Distributed Denial of Service (DDoS) protection), and how it deals with potential threats. In this sense, a secure and reliable pool will protect your earnings and operational continuity.

A pool that experiences constant outages (most often due to DDoS attacks) can lead to server outages, which can impact profits. For example, in 2020, Poolin, one of the largest Bitcoin mining pools at the time, was hit by a DDoS attack and its servers were flooded with malicious traffic, leading to outages and loss of revenue for participating miners.

Pool reputation: Apart from the above, it is always a basic step to research the reputation and transaction history of a pool before joining it.

However, there is still no guarantee that a reputable mining pool will not engage in suspicious behavior. For example, F2Pool, a leading miner by network hashrate, was criticized in 2023 when it began filtering transactions associated with addresses sanctioned by the U.S. Office of Foreign Assets Control (OFAC). The pool excluded certain transactions from its blocks and implemented external compliance measures. This went against Bitcoin’s censorship-resistance principle and was met with backlash from the community. F2Pool eventually stopped patching the filtering, but the gist of the situation remains the same.

Best Bitcoin Mining Pools

Listed below are some of the best Bitcoin mining pools based on criteria like hash power, popularity, payouts and fees, security, and other important factors.

Foundry USA

Foundry USA is the largest Bitcoin mining pool, controlling over 30% of the Bitcoin network by 2025.

Featured Features

- Institutional-grade services : In addition to standard pool operations, Foundry offers treasury management, BTC custody, and derivatives products for large enterprises.

- Security and Compliance : Foundry holds SOC 2 Type 1 and Type 2 certifications, which signify strong internal controls and operations. Additionally, all members must meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements before joining the pool. This can be a deterrent for miners who prefer anonymity, but it provides a safer environment for retailers and mining companies.

- Transparency and reliability : Offers detailed fee structures, exportable data, and in-depth analytics. This allows miners to evaluate and track their performance much more efficiently.

Fees and Payment Methods: Foundry USA offers a tiered structure that adjusts fees based on a miner’s quarterly average hash rate. Cuts are made from FPPS payments and include newly mined Bitcoin, block subsidies, and transaction fees. Under FPPS, miners receive regular and predictable payments, which are made daily.

Additionally, a minimum payout threshold of 0.001 BTC makes Foundry accessible to smaller-scale operations and allows for frequent distributions even for those who do not contribute large amounts of hashpower.

Hash Rate and Supported Equipment: Foundry USA is the largest mining pool contributing approximately 277 to 280 EH/s to the Bitcoin network. This means it finds blocks quickly and provides reliable payouts for participating miners.

The pool supports popular ASIC mining rigs such as Antminer S19 models, WhatsMiner M50 series, and AvalonMiner devices.

Pros :

- Stable FPPS payments that include transaction fees.

- High security with SOC certifications and strong compliance measures.

- Providing corporate services, credit, custody and advanced financial products.

- Advanced analytics and tools for miners.

Cons :

- KYC/AML requirements may be a deterrent for some miners.

- Holding more than a third of the network hash power means the pool has a huge impact on the Bitcoin network.

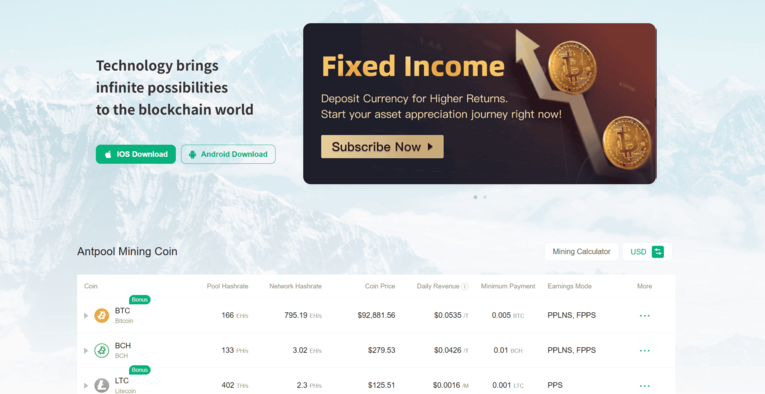

AntPool

AntPool was launched by Bitmain Technologies in 2014 and remains one of the most influential Bitcoin mining pools.

As of early 2025, it controls around 19% of the network’s total hash power and provides miners with a robust infrastructure and a variety of reward structures. While its primary focus is Bitcoin, AntPool also supports other proof-of-work (PoW) cryptocurrencies.

Featured Features

- Multi-currency support : Apart from Bitcoin, AntPool also supports popular PoW options like Bitcoin Cash (BCH) and Litecoin.

- Global servers : AntPool operates servers worldwide, reducing latency and void allocations. This network design provides more stable performance regardless of the miner’s geographic location.

- Daily payouts and reliability : Once a miner’s balance reaches 0.001 BTC, earnings are sent every 24 hours. Security measures include two-factor authentication (2FA), DDoS protection, and wallet locks to protect user accounts.

- Tools and resources for miners : The dashboard offers real-time hash rate metrics, detailed revenue histories, and integrated profitability calculators. These features simplify monitoring and help users optimize their operations.

Fees and Payment Methods AntPool offers three payment plans, and each comes with different fees, which impact individual earnings:

- PPLNS : 0% fee (transaction fees not included).

- PPS+ : 2.5% fee.

- FPPS : 4% fee.

Miners receive payments when they surpass 0.001 BTC. After this threshold is reached, distributions are made daily.

Hash Rate and Supported Equipment: With an output of approximately 132.7 EH/s, AntPool contributes close to 19% of the total Bitcoin network hash rate. AntPool accepts many ASIC mining devices, such as Bitmain’s Antminer series (S19 Pro, S19 XP), WhatsMiner (M50), and AvalonMiner devices. Although developed by Bitmain, other SHA-256 ASIC machines can also be connected without any problems.

Pros:

- Offering many payment models.

- 0% fee for PPLNS (transaction fees not included).

- Bitmain has long-standing mining expertise.

- Global server infrastructure to reduce latency.

Cons :

- FPPS has a higher fee (4%) than some alternatives.

- Large hash power share may raise centralization concerns.

- Some users find the interface less user-friendly than other repositories.

ViaBTC

ViaBTC is one of the best crypto mining pools known for its robust infrastructure, wide coin support, and comprehensive resources and tools for miners.

Based in China, ViaBTC is the third-largest Bitcoin mining pool in the world, controlling around 14% of the network’s total hash power as of early 2025. In addition to BTC, ViaBTC supports many other PoW cryptocurrencies.

Featured Features

- Wide range of assets : ViaBTC supports over 20 crypto assets, including BTC, BCH, LTC/DOGE (combined mining), ZEC, and DASH.

- Global servers : Distributed servers minimize latency and ensure stable connections for participants in different regions.

- Automatic conversion : Miners do not need to manually exchange their BTC earnings, the pool can automatically convert their earnings.

- Security measures : ViaBTC implements two-factor authentication (2FA), multi-level risk control systems, and wallet locks to increase account protection.

- Advanced tools and cloud mining : The pool offers real-time performance tracking, on-the-go monitoring with mobile apps, and cloud mining for those who want to mine without owning physical equipment.

Fees and Payment Methods ViaBTC offers PPS and PPLNS payment methods for miners, with fees of 4% and 2% respectively.

Hash Power and Supported Equipment ViaBTC contributes a hash power of approximately 83.5 EH/s, which is approximately 14% of Bitcoin's total hash power.

Additionally, ViaBTC supports ASIC miners for Bitcoin and other SHA-256 cryptocurrencies, and GPU rigs for altcoins like Ethereum Classic (ETC) or Zcash (ZEC). It also offers various installation guides for mining software like PhoenixMiner or T-Rex Miner.

The default minimum threshold for payout is 0.0001 BTC, making the pool accessible to smaller-scale participants. Miners receive payouts when they exceed this amount, and distributions are typically processed daily.

Pros and Cons Pros explained :

- Support for multiple cryptocurrencies for diversification

- Different payment methods

- Low payout threshold for small miners

- Strong security features

- Automatic conversion and other tools that simplify the user experience

Cons explained :

- PPS fees are higher than most competitors

- Cloud mining is still considered risky as it is often associated with market volatility

Luxor Mining Pool

Founded in 2018, Luxor Mining Pool is a North American-based operation known for its Full Pay Per Share (FPPS) model and support for a wide range of cryptocurrencies.

While its Bitcoin hash rate is lower than some market-leading pools, Luxor remains a strong option for miners looking for hourly pay, competitive fees, and additional services like Catalyst, which allows you to receive Bitcoin payments while mining altcoins.

Featured Features

- Catalyst service : Multi-coin miners can direct hash power to coins like Zcash or Dash but prefer Bitcoin payments, simplifying portfolio management across different networks.

- Global servers : Servers located in Asia, Europe, and America help reduce latency and increase uptime for miners worldwide.

- Advanced analytics and developer tools : Luxor's dashboard offers detailed performance tracking, API for custom integrations, and user-friendly resources for real-time monitoring.

- Security : The pool is SOC 2 Type 2 certified, hardens accounts with 2FA, and provides cloud redundancy to protect miner data.

- Tax reporting integration : By partnering with Luxor’s recommended platforms, miners can automate tax filings for cryptocurrency income, simplifying the compliance process.

Fees and Payment Methods The pool charges only 0.7% for Bitcoin under the FPPS system and provides hourly payouts based on shares sent, including block rewards and transaction fees. The fee structure for altcoins may vary, as some altcoins use the PPS or PPLNS models (sometimes 0% for PPLNS).

Luxor’s fee of 0.7% under FPPS is quite competitive, especially when compared to pools that pay per full payout.

Hash Rate and Supported Equipment Luxor contributes around 20 EH/s to the Bitcoin network, which puts it in a dominant position in North America, albeit behind some of its larger competitors.

The pool works with leading ASIC miners:

- Bitmain Antminer (e.g. S19 Pro, S19 XP).

- WhatsMiner (e.g. M50 series).

- AvalonMiner devices

GPU mining is also supported for some altcoins under the Catalyst feature. The minimum payout threshold for Bitcoin is 0.004 BTC.

Pros :

- Competitive 0.7% FPPS fee.

- Hourly payments for stable earnings.

- The Catalyst service converts altcoin earnings into Bitcoin.

- Strong security (SOC 2 Type 2, 2FA).

- Advanced analytics with developer-friendly API.

Cons :

- Around 20 EH/s so smaller than large pools like Foundry USA or AntPool.

- The high payout threshold (0.004 BTC) may be less practical for small-scale miners.

- No support for merged mining (cannot mine multiple coins under a single algorithm).

F2Pool

F2Pool is one of the longest-running and most diverse cryptocurrency mining pools on the market. Founded in 2013, the pool supports over 40 cryptocurrencies, including Bitcoin, Ethereum PoW (ETHW), Litecoin (LTC), and many other digital assets.

Featured Features

- Multi-currency support : F2Pool supports more than 40 cryptocurrencies. Different hardware is also compatible with these altcoins.

- Advanced tools : F2Pool offers in-depth statistics like real-time hash rate tracking, revenue history, and profitability projections. It also supports cross-platform access via web and mobile apps, allowing miners to easily track their operations.

- Security measures : Strong DDoS defenses and secure payment systems help minimize downtime. The company’s nearly a decade of experience speaks to its reliable infrastructure and ability to respond quickly to potential threats.

Fees and Payment Methods: F2Pool offers three different payment models depending on the user's needs: PPS+, FPPS and PPLNS.

F2Pool’s Bitcoin mining fees vary depending on the payout model, typically ranging from 2% for PPLNS to 4% for FPPS. This may be a bit higher than some smaller pools, but many miners find the pool’s stability and reliability to be worth it. Again, it all depends on the user’s goals and needs.

Bitcoin miners can expect a default payout threshold of 0.005 BTC, which they can change at their own discretion in their account settings.

Hash Power and Supported Equipment: F2Pool will provide around 10% of the total hash power of the Bitcoin network in 2025, which is around 81.4 EH/s. This allows the pool to generally find blocks quickly. It is also compatible with modern ASIC devices such as the Antminer S19 series, and F2Pool also supports GPU mining for some altcoins.

Pros and Cons Pros explained :

- A solid track record since 2013.

- A wide range of cryptocurrencies that can be mined.

- Comprehensive mining statistics and real-time monitoring.

- Strong security and DDoS protections.

Cons explained :

- Higher fees than some competing pools.

- It has been involved in controversial practices that contradict the decentralized nature of Bitcoin, leading to concerns about centralization in Bitcoin mining.