Top 5 Best Staking Platforms in 2025

Looking for the best ways to stake your cryptocurrencies? Here are the best staking platforms available right now!

Crypto staking is the cornerstone of every Proof-of-Stake (PoS) blockchain. Without staking, most crypto networks would not be able to maintain security and transaction verification mechanisms. Therefore, it is of great importance.

Staking also provides a financial incentive for validators to act honestly. Validators may lose some or all of their staked tokens if they engage in malicious behavior or fail to perform their duties.

Another important point is that staking plays a critical role in keeping blockchain ecosystems decentralized, providing a systematic way to reward users who contribute to the health and functioning of the network.

This article takes a closer look at the best crypto staking platforms, evaluating their functionality and the assets they support. It also covers the basics of staking and how to stake using different methods.

What is DeFi Staking?

Staking is the process of locking cryptocurrencies in a wallet to secure and support the sustainability of a blockchain network. In blockchains that use the Proof of Stake (PoS) consensus mechanism, users typically earn additional cryptocurrency rewards for the tokens they stake. With staking, you contribute to the security of the network, verify transactions, and help create new blocks on the blockchain.

In summary, staking encourages honest behavior. Users earn rewards for supporting the operation of the network, while malicious or irresponsible validators risk losing some or all of the tokens they stake. This system encourages active participation and preserves the integrity of the blockchain.

Advantages of Crypto Staking

Staking offers several benefits not only for users but also for blockchain networks and DeFi protocols:

Generating Passive Income

Staking allows you to earn rewards without selling your cryptocurrencies, creating a regular source of passive income. If the earned rewards are staked again, you can increase your total earnings through the compounding effect.

High Returns

Annual percentage returns (APY) can range from single digits to over 20% depending on blockchain and market conditions, making staking a more profitable option compared to traditional financial instruments.

Greater Accessibility and Network Support

Unlike Proof of Work (PoW) blockchains, staking does not require specialized hardware or high energy consumption. In PoS networks, it is only necessary to stake a certain amount of tokens, making the process accessible to a wider range of users.

By locking tokens, you also verify transactions on the blockchain, protect the network from threats like 51% attacks, and ensure its long-term stability. This way, users who stake are rewarded for contributing to the health of the network.

Liquidity Options

Liquidity staking derivatives (Lido’s stETH, Rocket Pool’s rETH, etc.) allow staked assets to be used on DeFi platforms so you can continue to earn staking rewards and use those assets for additional trading or lending.

Restaking

Some popular protocols (such as EigenLayer) allow previously staked tokens to be re-staking. With this method, tokens can be used as collateral or included in different staking systems. Re-staking offers the opportunity to increase returns and further participate in the DeFi ecosystem. The biggest advantage is that it allows DeFi projects to benefit from the security and capital of existing networks.

This topic will be covered in more detail in the article, but for now the most important thing to know is that re-staking is much more complex than traditional or liquid staking. It requires more responsibility and technical knowledge.

Best Crypto Staking Platforms of 2025

Below, we have reviewed the best staking platforms in detail along with their features, supported assets, and other important information.

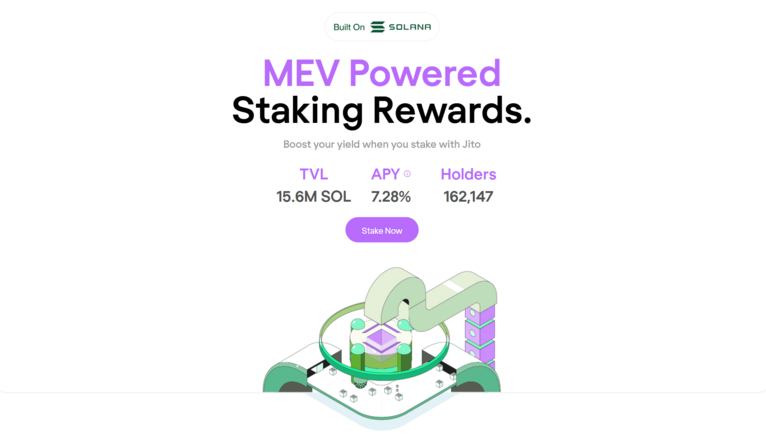

Jito: Solana's Largest Liquid Staking Platform

Jito is the largest liquid staking platform on the Solana blockchain. Users stake SOL and receive JitoSOL in return . This acts as a liquid staking token (LST) that can be used in other Solana-based DeFi projects . This way, even if users have locked up their staked assets, they can still earn additional returns by using their tokenized versions in different DeFi projects.

What is JitoSOL?

Jito’s MEV approach is often seen as controversial. Some critics argue that MEV exploits traders by front-running or reordering trades, while others say it increases market efficiency and solidifies lenders’ repayments.

Jito uses an auction system to mine MEV. Traders bid on the most profitable trade sequences. Third-party block engines simulate these bids to determine the most valuable trade groups. The resulting profits are funneled to validators and JitoSOL owners, reducing spam and increasing staking rewards.

Jito's Basic Features

Liquid Staking (JitoSOL): Users stake SOL and receive JitoSOL in return. JitoSOL can be used on DeFi platforms (lending, trading, liquidity pools, etc.) while still earning staking rewards.

MEV Integration: Jito redistributes revenue from MEV to JitoSOL holders by optimizing transaction ranking, increasing overall staking returns.

Fully Decentralized Governance: Jito’s governance token, JTO, gives holders the right to vote on the platform’s delegation strategies, treasury management, and protocol updates, while the Jito DAO provides a community-driven oversight mechanism.

Security and Transparency: Jito relies on audited smart contracts and delegates staked SOLs to recognized validators in the Solana ecosystem. The governance of the Jito DAO increases the transparency of the platform.

Supported Assets

Jito currently only supports SOL tokens as it only integrates with the Solana blockchain.

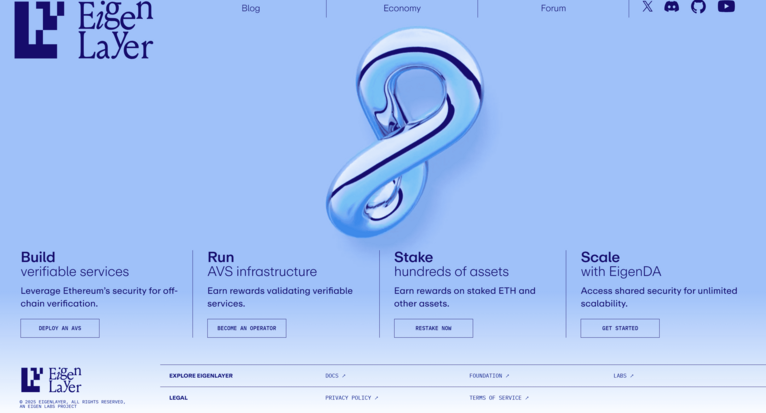

EigenLayer: King of Restaking

EigenLayer is a middleware protocol built on Ethereum and is one of the projects that pioneered the concept of restaking. Restaking refers to the depositing of previously staked ETH (such as stETH) into a new liquidity pool. These staked assets are then distributed across systems such as different decentralized applications (dApps), Active Verification Services (AVS), oracles, Layer 2 networks, data availability layers, and interchain bridges.

What is EigenLayer?

This method allows EigenLayer to benefit from Ethereum's strong security without requiring other projects to create their own independent validator networks.

EigenLayer Key Features

Restaking Marketplace: EigenLayer works like a marketplace. Validators and protocols can negotiate shared security for a set cost. Protocols can purchase staked tokens or stETH to provide an additional layer of security. Validators can evaluate the risk-return balance and manage their capital allocations in a balanced way by choosing which protocols they want to secure.

Thanks to Flexible Staking Options, users can;

- You can make individual (solo) stakes,

- Can run their own validator nodes,

- Can transfer their stakes to third parties,

- It can perform dual staking (ETH and a native token can be staked simultaneously).

Thanks to this flexibility, EigenLayer attracts advanced validators, users, and developers to its ecosystem.

Programmability: Developers can create custom validation rules and security parameters for EigenLayer-based applications, enabling innovative security solutions such as multi-token validation mechanisms tailored to specific risk profiles.

Modular Security: EigenLayer offers a modular structure, allowing staked assets to be secured for specific functions such as storage, DeFi applications, or cross-chain bridges. This flexibility allows each project to create a structure that fits their own security needs.

Supported Assets

EigenLayer currently supports assets like ETH, ERC-20 tokens, and liquid staking tokens (Lido's stETH and Rocketpool's rETH).

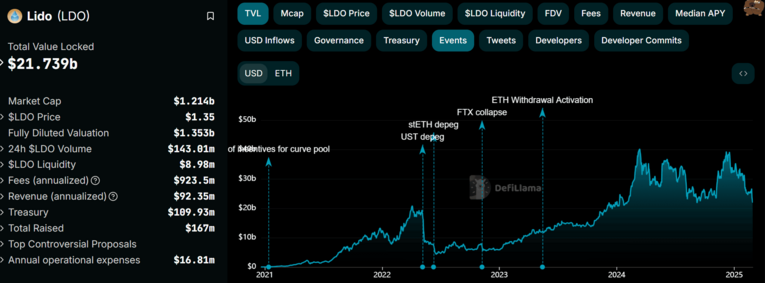

Lido Staking: The Leader of Liquid Staking

Lido is one of the largest platforms in the decentralized liquid staking space. With total assets locked (TVL) reaching $40 billion by mid-2024, it has become one of the largest players in the DeFi ecosystem.

Lido TVL (Total Locked Value)

The appeal of Lido is simple: users can earn staking rewards without having to withdraw the assets they stake. This is the basis of the liquid staking model. Lido allows users to freely use their assets by issuing tokenized staking assets like stETH.

In this way, users can earn additional income by using stETH in different DeFi projects on Ethereum.

Key Features of Lido

Liquid Staking: When you stake on Lido, you get a derivative token (e.g. stETH) at a 1:1 ratio. Additionally, anyone can stake any amount they want (but a minimum of 32 ETH is required for validators).

Validator Distribution: Stake tokens are distributed among professional validators selected by Lido DAO, reducing the risk of validator errors or penalties.

Open Source and Audited System: Lido’s smart contracts are publicly available and regularly audited. Audit reports are published on GitHub.

Fee Structure: Lido takes a 10% commission on staking rewards. This fee is shared between node operators and the Lido DAO treasury.

Supported Assets

Lido supports many different crypto assets:

- Ethereum (ETH): The most common staking option on Lido.

- Polygon (MATIC): stMATIC olarak tokenize edilir.

- Kusama (KSM): Tokenized as stKSM.

- Polkadot (DOT): Tokenized as stDOT.

However, support for Solana (SOL) has been removed. Due to community votes and long-term unsustainable fee structure, the Lido team has terminated SOL staking service.

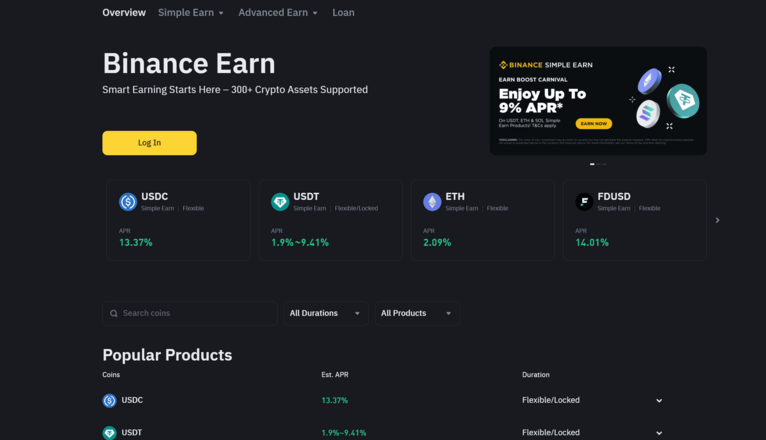

Binance Earn: Earn Passive Income from Your Crypto Assets

Binance Earn is a yield platform developed to provide passive income to investors within the Binance ecosystem. Suitable for both beginners and experienced investors, this platform offers different staking and savings options.

Binance Earn allows users to earn income by locking or liquid staking their crypto assets for specific periods. In particular, the locked staking program offers higher returns over 30, 60, or 90-day terms.

Key Features of Binance Earn

DeFi and Liquid Staking: Users can earn higher annualized yields (APY) by connecting to DeFi protocols, but this comes with the risks that come with decentralized platforms. Binance also offers ETH 2.0 Staking, so users can stake Ethereum without running their own validators. In return, they receive BETH tokens, an asset representing the ETH they staked.

Savings Products:

- Flexible Savings: Users can withdraw their funds at any time, but interest rates are lower.

- Locked Savings: Requires locking assets for a certain period of time for higher returns.

Dual Investment: It is a product designed for advanced investors. It offers the opportunity to obtain high returns depending on market conditions by using two different cryptocurrencies.

BNB Vault: A private investment pool for BNB holders. It combines staking, savings, and liquidity mining to maximize returns on BNB holdings.

Supported Assets

Binance Earn supports over 180 crypto assets. The main supported assets are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Stablecoins: USDT, USDC and more

Binance Earn caters to different risk profiles by offering a wide range of options to turn your cryptocurrencies into passive income sources.

Ethena: Crypto-Collateralized Stablecoin

Ethena (USDe) is a synthetic stablecoin built on Ethereum, backed by crypto collateral and maintaining a 1:1 dollar peg with delta-neutral risk management.

Ethena.fi (Image Source: Ethena.fi)

Developed by Ethena Labs, the platform offers a decentralized and censorship-resistant alternative to traditional stablecoin models. USDe’s value is based entirely on crypto assets, not fiat reserves.

Basic Features of Ethena

- USDe – Delta-Neutral Stablecoin: USDe is backed by short positions opened in derivatives markets to hedge against price fluctuations of collateralized assets. This maintains the value of the stablecoin at $1 and eliminates reliance on fiat reserves or centralized custody services.

- Crypto Collateral: The entire USDe supply is backed by crypto assets on the blockchain:

Ethereum (ETH)

Staked Ethereum (stETH)

Bitcoin (BTC)

Other stablecoins

This model ensures the sustainability of the stablecoin by always maintaining a sufficient collateral ratio.

Yielding Token – sUSDe: Users who stake USDe earn the yielding derivative token sUSDe.

Sources of income:

- Ethereum staking rewards

- Funding revenues from delta-neutral derivative positions

The sUSDe token gains value over time through the returns it accumulates using the ERC-4626 Token Vault standard.

Insurance Fund: Ethena offers a reserve fund to increase security in the decentralized finance (DeFi) space.

This fund acts to maintain the stability of the USDe value by stepping in during times of extreme market volatility, negative funding rates or crisis.

Supported Assets and Staking

Ethena allows you to earn sUSD by staking USD. sUSD gains value over time by reflecting returns from derivative funding revenues and Ethereum staking rewards.

By offering an innovative approach to decentralized stablecoin solutions, Ethena aims to create a stablecoin model that is both secure and yielding.

Crypto Staking Guide: Step by Step Guide

There are different methods to stake crypto. But no matter which method you choose, you must first have a secure crypto wallet. You can check out our guide to comparing the best DeFi wallets.

1- Staking with Crypto Wallets

Some crypto wallets allow you to stake directly from within the app.

Some of these wallets include:

- Trust Wallet

- Exodus

- Phantom

How to Stake in Phantom Wallet?

Go to your wallet and select the asset you want to stake. Click on the selected asset and select “Stake”. Phantom offers two different staking methods:

Native Staking: Earn rewards by locking your crypto assets directly on the Solana blockchain.

Liquid Stake: You can stake liquid using platforms like Jito and use the staked assets you earn in DeFi applications.

Native Staking Benefits: More secure and stable, but your assets remain locked and cannot be used for other transactions.

Liquid Staking Advantages: Offers higher rewards and lower fees. You can use it in DeFi protocols by receiving tokens like JitSOL in exchange for staked assets.

2- Staking Using Staking Platforms

You can stake even small amounts by joining staking pools through cryptocurrency wallets.

For example, if you want to stake Ethereum (ETH):

- Go to a platform like Lido.

- Select the amount of ETH you want to stake.

- After confirmation, receive stETH tokens.

With this method, you can stake your ETH and use it in DeFi protocols at the same time.

Who is it best for? Suitable for users who cannot meet minimum staking requirements or want to liquidate their funds.

Staking is an effective way to both earn passive income and secure blockchain networks. You can invest your crypto assets by choosing the staking method that suits your risk tolerance and strategy.

Node Staking

Node staking is a more complex process and is suitable for users running a validator node on Solana or Ethereum.

How Does It Work?

Validators stake their own assets while also managing the assets of liquid staking users.

They earn rewards from the assets they stake.

They also receive commissions from the earnings of users in the pool they manage.

Best Node Staking Platforms:

- Rocketpool: One of the largest ETH staking pools. A minimum of 16 ETH is required to run a node and a 14% commission is deducted from the rewards.

- StakeWise V3 and Marinade Finance: Alternative staking platforms for Solana users.

Staking on the Exchange

Staking via an exchange allows centralized platforms like Binance or Coinbase to manage the staking process on your behalf.

Advantages:

- You can stake without any complications.

- You can stake different cryptocurrencies and stablecoins with certain maturity options.

For example, Binance Earn. Binance Earn offers a variety of staking products, from popular coins to stablecoins, with different options and annualized returns (APRs).

Frequently Asked Questions (FAQ)

- Can I withdraw staked assets?

Yes, but depending on the protocol there is a cooldown period. This period is necessary to prevent sudden withdrawals by validators and to ensure the security of the network. - What is the difference between Native Staking and Liquid Staking? In native staking, users lock their assets and earn rewards directly on the blockchain. In Liquid Staking, users receive tokenized versions of their staked assets (e.g. stETH or JitSOL) and can invest these assets in DeFi projects.

- Why is Restaking more complex than traditional staking?

Restaking allows you to use already staked tokens as collateral across different protocols. The advantage of Restaking is that it provides additional security to DeFi protocols while compounding earnings. The disadvantage is that it requires technical knowledge and higher risk management as it requires interaction with multiple smart contracts and DeFi protocols.